Australia is emerging from the global pandemic sooner and at less economic cost than expected, but with record levels of unemployment and increased government debt. Despite Victoria’s second wave of the virus and the uncertainty surrounding interstate and international trade, Australia’s economic recovery from COVID-19 is underway.

Along with countries all over the world, the pandemic rapidly changed Australian industries and business structures as soon as the first case was identified on 25 January 2020. Businesses deemed ‘non-essential’ such as pubs, restaurants, cafés and many more were forced to close their doors. An important decision was made to classify mining, as well as most construction, manufacturing and retail businesses as essential services, as they were deemed to be key for economic recovery.

Australian Mining continued operation during the COVID-19 outbreak as it was deemed an essential service on 29 January 2020.

Casting forward nearly nine months and the Australian Mining sector has posted a mixed performance in response to the COVID-19 pandemic. Revenue fell by an estimated 14.1% in 2019-20, as a result of significant contractions in the prices of coal and natural gas. However, the sector has benefited from strong iron ore prices, which have boosted the performance of major firms. The mining sector is projected to recover at 2.8% annually over the next five years.

COVID-19 is expected to cause less disruption to the mining sector relative to other segments of the Australian economy. The impact within the industry is expected to be primarily limited to significant changes in commodity prices. However, a significant decline in oil and gas prices has reduced operating costs for most mining establishments, balancing out some of the interruptions.

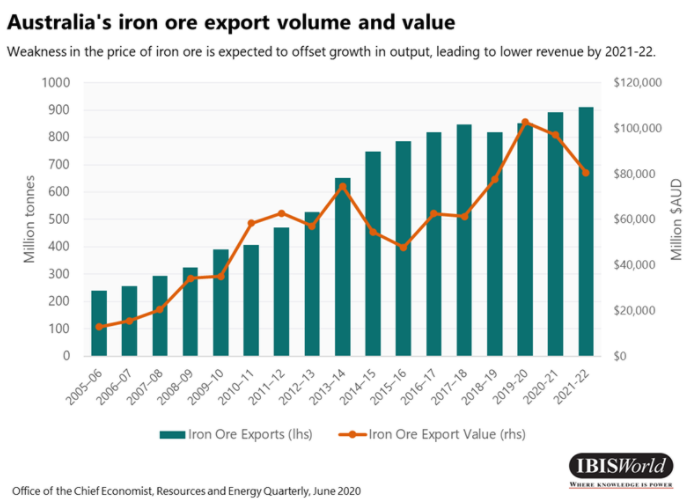

Iron ore

The largest segment of the mining sector in Iron ore has continued to be a strong performer throughout the COVID-19 pandemic. Despite a contraction in global demand as a result of lower steel production, iron ore prices remained above AU$110 per tonne in the early phases and have continued to rise to a six year high of $170 per tonne as of today. This has led to an estimated $103 billion in export revenue in 2019-20, the highest level of export revenue on record.

As output from other major iron ore suppliers such as Brazil begin to normalise, Australia’s market power will be reduced, and iron ore prices will begin to decline. Though it is expected that Australia’s total iron ore export volume will continue to rise through this period.

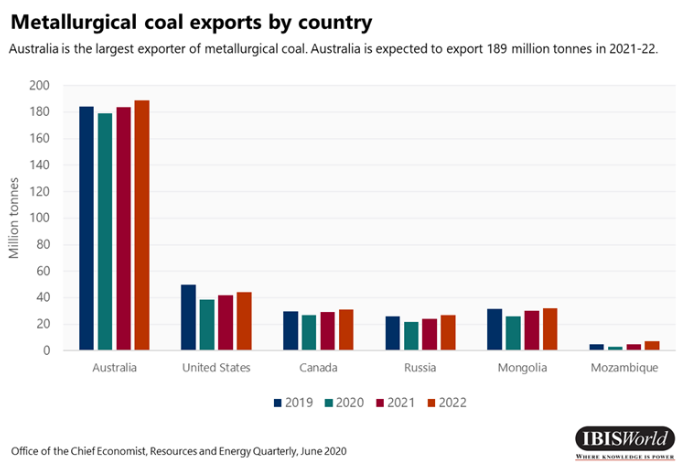

Coal

Australia is the world’s largest exporter of metallurgical coal and the second largest exporter of thermal coal. The Australian coal mining industry has been severely disrupted by the COVID-19 pandemic, further amplifying pre-existing difficulties for Australian coal miners.

Coal prices have fallen significantly throughout 2020 with revenue for the Australian coal mining industry expected to decline by 11.7% in 2019-20. This has shifted the outlook for coal mining in Australia where prior to the coronavirus, investment in new coal mines was anticipated to rise over the next five years. The pandemic has put a hold on many expansion projects and large investment decisions until there is some positive market certainty.

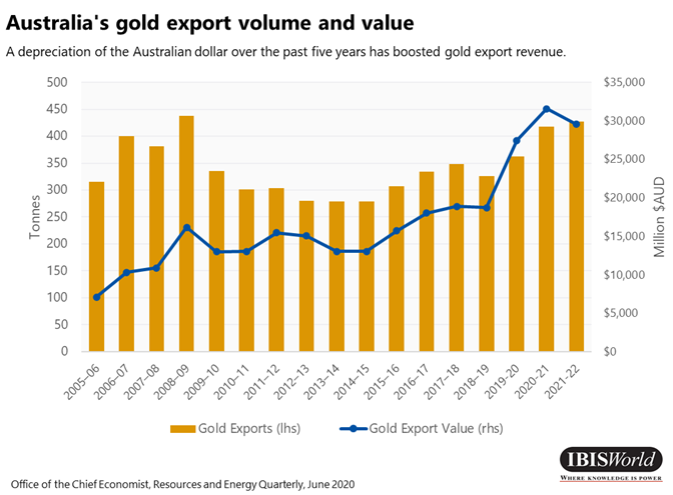

Gold

Demand for gold as a safe asset has surged amid unprecedented economic uncertainty, driving the price of gold to an eight year high of over AU$2800 per ounce.

COVID-19 has had a mixed effect Australian gold mining operations. Lower oil prices have significantly reduced operating costs, though there have been disruptions with Western Australia’s FIFO workers due to containment regulations. Despite these disruptions, Australian gold mining output is expected to increase by 4.3% in 2019-2020.

The outlook for the gold mining industry over the next 5 years is positive, despite an anticipated decline in production volume. Revenue is forecast to increase at an annualised 2% over the five-year period.

Though it is still unclear what further impact COVID-19 will have, the Australian mining industry will continue to play an integral role in Australia’s economic recovery from the coronavirus.

Source: IBISWorld – The Outlook for Australian Mining

About The Author: Rhys Werndly

More posts by Rhys Werndly